Renters Insurance in and around Roseville

Welcome, home & apartment renters of Roseville!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - location, outdoor living space, parking options, house or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Welcome, home & apartment renters of Roseville!

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

When the unpredicted accident happens to your rented apartment or space, usually it affects your personal belongings, such as a set of golf clubs, a laptop or a stereo. That's where your renters insurance comes in. State Farm agent Kandiss Ecton is committed to helping you examine your needs so that you can protect your belongings.

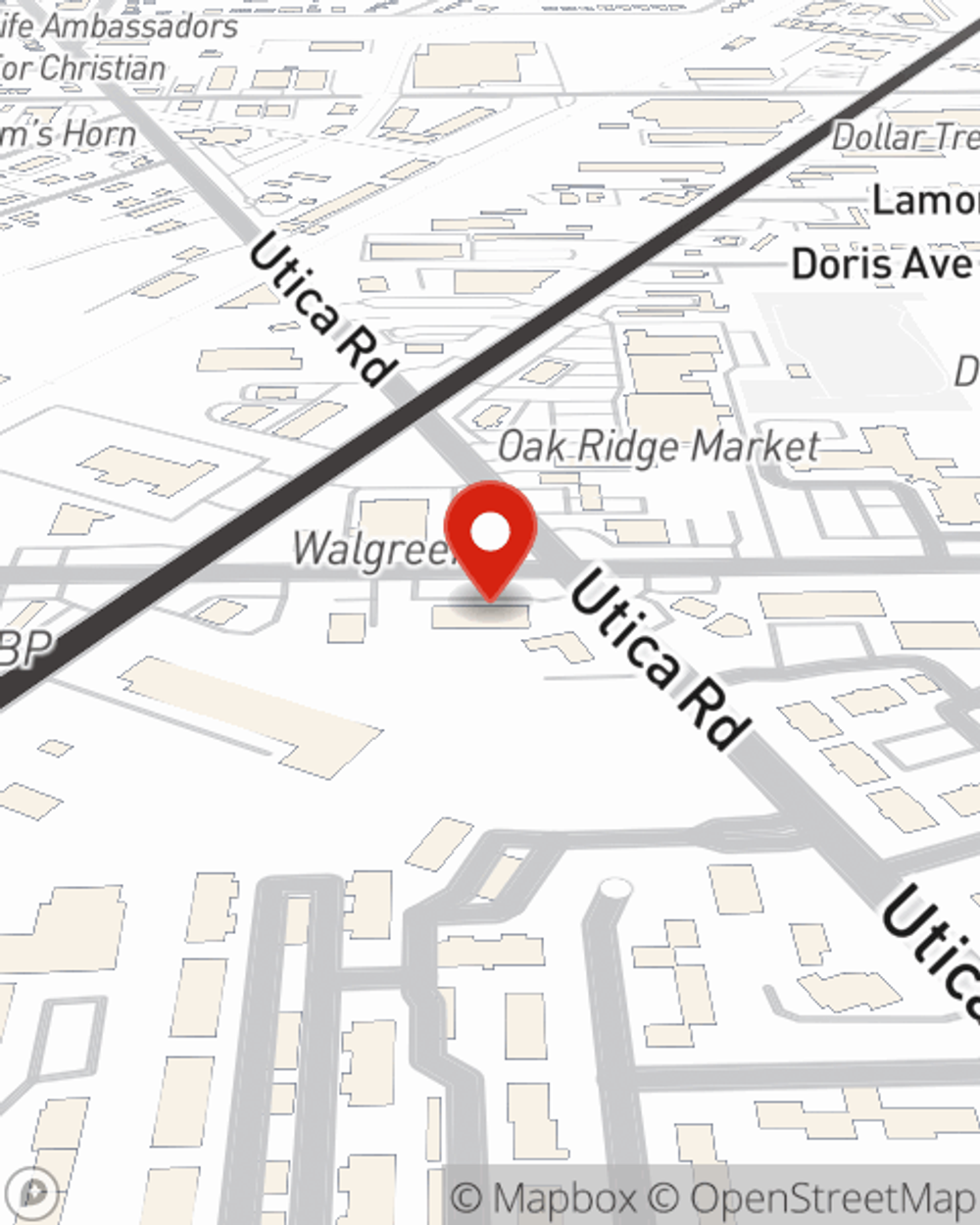

Renters of Roseville, State Farm is here for all your insurance needs. Get in touch with agent Kandiss Ecton's office to get started on choosing the right policy for your rented townhome.

Have More Questions About Renters Insurance?

Call Kandiss at (586) 771-4050 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Kandiss Ecton

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.