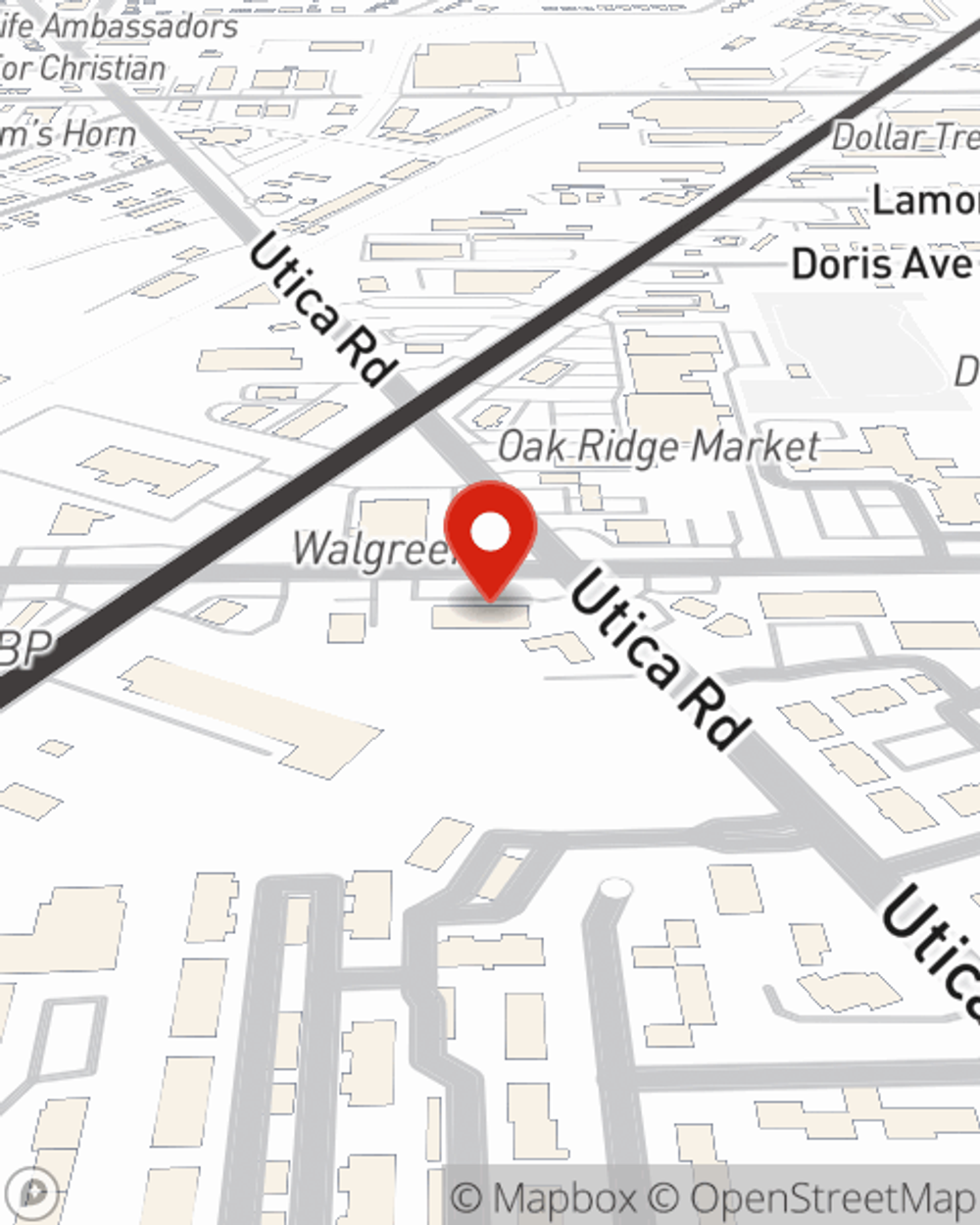

Business Insurance in and around Roseville

One of Roseville’s top choices for small business insurance.

No funny business here

This Coverage Is Worth It.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Kandiss Ecton. Kandiss Ecton relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of Roseville’s top choices for small business insurance.

No funny business here

Protect Your Future With State Farm

If you're looking for a business policy that can help cover loss of income, computers, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

At State Farm agent Kandiss Ecton's office, it's our business to help insure yours. Reach out to our outstanding team to get started today!

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Kandiss Ecton

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.